Perhaps my mind fails me, but in years past, I recall receiving a pleasant marketing letter from the Mayor extolling the hard work that went into limiting the annual increases in our property tax bills. This year, I found only the bill. I’ve emailed the Mayor’s office asking for comments on this.

Perhaps, given the size of this year’s increases, they did not want to be that closely identified with the tax bills? (OTOH, eliminating the letter does save a few dollars).

Search Results for: Property tax

Fred Mohs on Property Tax Exemptions

The local papers have been full of troubling news about the budgets for the city, county and public schools. The sheriff needs more deputies, drug and alcohol treatment centers are left unfunded, park and sanitation workers are cut, West High School does not have money to put on its fall play, fourth grade strings are in jeopardy and fees for doing everything are up across the board.

At the same time, a growing number of Madisonians have managed to live in properties that are tax exempt. A report produced by the Madison Assessor’s Office indicates that the self-reported value of retirement home parcels is $25.1 million and that other tax exempt housing has a value of $64.3 million, for a total self-reported value of $89.4 million.

Democratic Plan to Reduce Property Taxes

The Assembly’s Democratic leader says he will offer a plan next year to exempt the first $100,000 of an owner-occupied home’s value from property taxes for public schools.

The change would lower property taxes on the average home by about $950 a year, according to the Legislative Fiscal Bureau.

Rep. James Kreuser (D-Kenosha) said his plan to amend the Wisconsin Constitution could not become law until 2007, at the earliest.

Still, he said, it would be better than Republicans’ plans to limit property tax bills for the next three years, while they try to rewrite the constitution to control state and local government spending.

Meanwhile, Avrum Lank says that a Tax Foundation study ranks Wisconsin 41st out of 50 states in business tax climate.

Property Tax Assessments Going Down? – Silicon Valley

Kelly Zito writes that:

The Santa Clara County assessor has slashed the values of about 1, 200 office and industrial buildings by about $8 billion, further underscoring Silicon Valley’s protracted high-tech slump.

County officials boosted assessed values of about 9,500 homes and condos that had been cut last year, but more than 23,000 residential properties continued to receive reductions totaling about $1.7 billion, they said Thursday.

Madison’s property values have risen for years. Someday, there will be an adjustment, which will be painful for its tax base.

Madison Property Taxes: “Everybody’s Richer”

According to city assessor Ray Fisher Friday when 2004 property assessments were released. “My house went up 10 percent this year. I look at it as money in my pocket.” – Beth Williams writes. Interesting perspective…. Can’t say that I agree with Ray on that one. Bill Novak writes:

“Last year, assessments went up 8.6 percent and the local real estate tax was up 7.1 percent, according to the Assessor’s Office. In 2002, assessments were up 8.1 percent and taxes went up 3.2 percent. In 1997 and 1999, assessments went up and taxes went down.” What about 1998, 2000 and 2001?

There has been talk in the state legislature of completely shifting school taxes from the property tax to other sources, such as the sales tax. Wayne Wood, a retiring representative from Janesville and Rep Mickey Lehman (R-Hartford) developed a proposal that would have used a sales tax increase to reduce property taxes for schools.

Tax Avoidance & Intellectual Property

Dave writes about Amazon’s controversial one-click purchase patent (many business process patents, are I believe an abuse of the patent process). Evidently, Amazon assigned their patent(s) to Deutsche Bank as part of a credit agreement between 1995 and 1997.

I wonder if there might be a tax shelter angle to this (amazon was generating huge losses at the time, and other firms might wish to do a deal for the tax benefits of those losses)? Years ago, I worked for a major international beverage firm. One of their (this firm was not unique) tax reduction/avoidance strategies was to create the flavors in tax havens (Puerto Rico, Cyprus, Ireland among other places) and sell that essential component back to US entities at high prices (this is of course a rather simplistic analysis). The US entities then generated small margins or losses while the offshore unit generated the large margins. This tax strategy, among many others is discussed in the very enlightening book by NY Times reporter David Cay Johnston: Perfectly Legal.

Deutsche Bank, like many others, has been part of a number of tax shelter strategies.

This abusive patent process is the major reason I do not link to amazon (barnes & noble online is a fine alternative).

Airdrop trumps $40B Taxpayer Medical Record Subsidies

I recently compiled a bit of long term, personal medical history along with an image or two prior to meeting a new physician. I sought to share this digital information efficiently, and save everyone time, if not money.

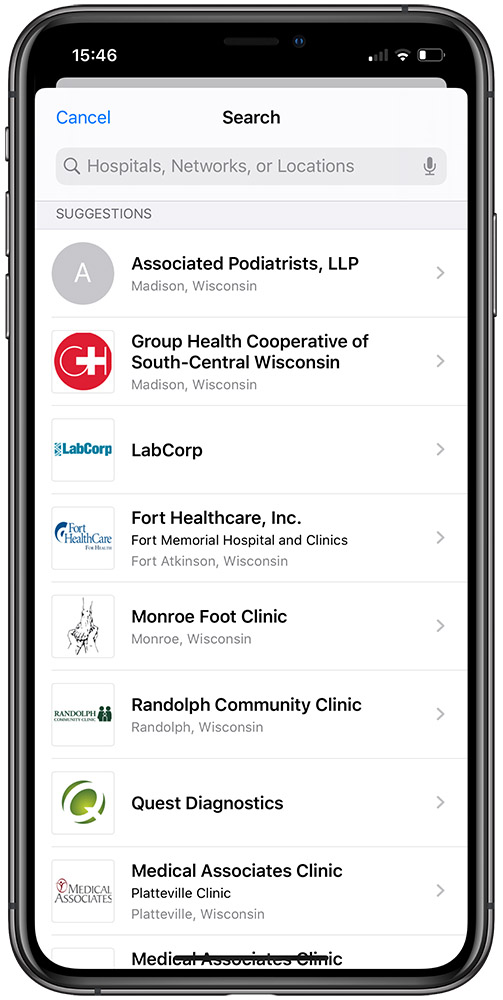

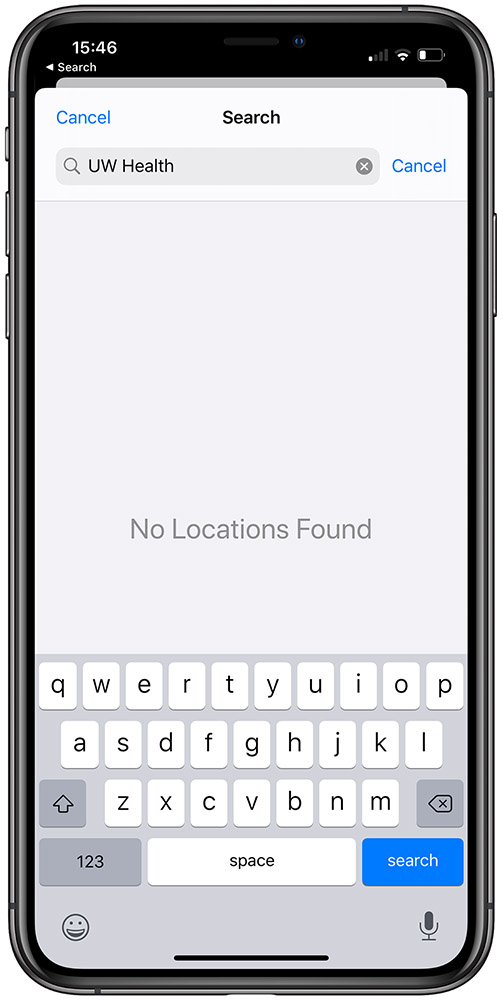

However and unfortunately, Epic Systems’ My Chart app (Madison, WI based UW Health implementation) lacks the ability to ingest and share patient sourced images or documents…..

A few days later, in clinic, I used iOS’s AirDrop to share the text and graphics to the physician’s iPhone. While helpful, the lack of patient sharing tools meant that a clinic visit was required along with ever increasing deductibles.

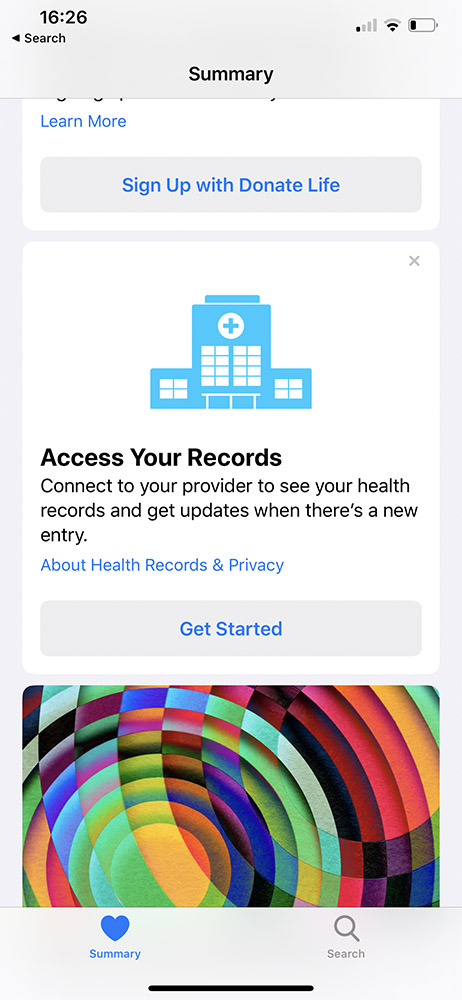

Many healthcare providers share personal medical record data via the iPhone’s health app.

However and unfortunately, $3.65B UW Health’s Epic medical records cannot be shared to my iOS health app.

We continue to pay more for less.

The lack of interoperability is a reminder that US taxpayer’s now $40B back door electronic medical record subsidy has been a failure. Costs have exploded and we citizens lack data portability, despite the legislation’s requirement:

The HITECH Act set meaningful use of interoperable EHR adoption in the health care system as a critical national goal and incentivized EHR adoption.[7][8] The “goal is not adoption alone but ‘meaningful use’ of EHRs—that is, their use by providers to achieve significant improvements in care.”[9]

There are pockets of innovation. One Medical’s app supports video visits:

Thankfully, the visit was of no consequence, other than time and money.

Additional reading:

Death By 1,000 Clicks: Where Electronic Health Records Went Wrong

Madison’s Property Tax Base Growth; $38B+ Federal Taxpayer EMR Subsidy

Stillborn 2007 Wisconsin $30M EMR subsidy.

A reader asked me to write tonight about the Health Information Technology for Economic and Clinical Health Act, which is about as far from something I would like to write about as I can imagine, but this is a full service blog so what the heck. The idea behind the law is laudable — standardized and accessible electronic health records to allow any doctor to know what they need to know in order to treat you. There’s even money to pay for it — $30 billion from the 2009 economic stimulus that you’d think would have been spent back in 2009, right? Silly us. Now here’s the problem: we’re going to go through that $30 billion and end up with nothing useful. There has to be a better way. And I’m going to tell you what it is.

The costly flaws in U.S. digital health-data plan

Microsoft’s Irish Tax Shelter

The citizens of other nations where Microsoft sells its products are less fortunate. Round Island One provides a structure for Microsoft to radically reduce its corporate taxes in much of Europe, and similarly shields billions of dollars from U.S. taxation.

Giant U.S. companies whose products are heavily based on their innovations, such as technology and pharmaceutical firms, increasingly are setting up units in Ireland that route intellectual property and its financial fruits to the low-tax haven — at the expense of the U.S. Treasury.

Much of Round Island’s income is licensing fees from copyrighted software code that originates in the U.S. Some of the rights to these lucrative assets end up in Ireland via complex accounting rules on intellectual property that the Treasury is now seeking to overhaul. The Internal Revenue Service said it is also looking closely at how companies account for such transactions.

In a statement, Microsoft said its European units “report and pay significant amounts of taxes” and that Microsoft “is fully compliant with the tax laws of the United States and all other countries.”

Through a key holding, dubbed Flat Island Co., Round Island licenses rights to Microsoft software throughout Europe, the Middle East and Africa. Thus, Microsoft routes the license sales through Ireland and Round Island pays a total of just under $17 million in taxes to about 20 other governments that represent more than 300 million people.

Microosft is not unique. Many firms route their IP through tax havens such as Ireland, Puerto Rico, Cyprus and others.

This tax saving process occurs in everyday products (for some) as well, such as Pepsi & Coke. Both beverage giants locate their flavor facilities in tax havens.

Our Tax Dollars At Work for Hollywood: Anti-Copying Attaches

Commerce is making ready a team of intellectual property (IP) specialists to deploy to nations giving us fits on piracy. Sort of a WTO-enforcing SWAT team.

The lead experience here is China, and that is all fine and good. This is where our “conflict” with China should really be centered: in economics and in rules.

Other countries targeted are all either New Core (Russia, India, Brazil) like China, or key Seam States (Thailand) or places where we’re making a special trade effort to shrink the Gap (Big Bang-land Middle East).

Good move, I say. One the White House can point to in upcoming trade pact battled with Congress, which, in its infinite wisdom, is moving more and more toward protections as a catch-all answer for America’s economic woes. Bad, stupid, ahistorical choice, but there it is.

AMT Snaring More Taxpayers

Avrum Lank takes a look at the AMT – extensively discussed here:

“It’s just another example of smoke and mirrors,” said Paul S. Wickert, owner of Acc-U-Rite Tax & Financial Services Inc., a tax preparation firm on Milwaukee’s south side. “They show you a 20 percent rate with one hand while their other hand is in your back pocket” grabbing more. The AMT tax rate varies from 26% to 28% of earned income, while regular tax brackets go from 10% to 35%.

The impact is especially great for large, middle-class families in states with high income and property taxes, such as Wisconsin. The AMT disallows deductions for local taxes, and does not take into account all of the personal exemptions allowed under the regular tax law.