Quite a bit of work moving snow today, but, the early morning scenery was quite beautiful.

Will Big Business Save the Earth?

THERE is a widespread view, particularly among environmentalists and liberals, that big businesses are environmentally destructive, greedy, evil and driven by short-term profits. I know — because I used to share that view.

But today I have more nuanced feelings. Over the years I’ve joined the boards of two environmental groups, the World Wildlife Fund and Conservation International, serving alongside many business executives.

As part of my board work, I have been asked to assess the environments in oil fields, and have had frank discussions with oil company employees at all levels. I’ve also worked with executives of mining, retail, logging and financial services companies. I’ve discovered that while some businesses are indeed as destructive as many suspect, others are among the world’s strongest positive forces for environmental sustainability.

The embrace of environmental concerns by chief executives has accelerated recently for several reasons. Lower consumption of environmental resources saves money in the short run. Maintaining sustainable resource levels and not polluting saves money in the long run. And a clean image — one attained by, say, avoiding oil spills and other environmental disasters — reduces criticism from employees, consumers and government.

Much more on Jared Diamond here.

Musée de l’Orangerie Panorama

Click to the image above to view this August, 2007 (hand held) panoramic image of Monet’s water lillies. Musée de l’Orangerie website. This journey and image made possible by the generosity of my parents!

Throwing Computers At Healthcare

Computerworld reports on an extensive new Harvard Medical School study, appearing in the American Journal of Medicine, that paints a stark and troubling picture of the essential worthlessness of many of the computer systems that hospitals have invested in over the last few years. The researchers, led by Harvard’s David Himmelstein, begin their report by sketching out the hype that now surrounds health care automation:

Enthusiasm for health information technology spans the political spectrum, from Barack Obama to Newt Gingrich. Congress is pouring $19 billion into it. Health reformers of many stripes see computerization as a painless solution to the most vexing health policy problems, allowing simultaneous quality improvement and cost reduction …

In 2005, one team of analysts projected annual savings of $77.8 billion, whereas another foresaw more than $81 billion in savings plus substantial health gains from the nationwide adoption of optimal computerization. Today, the federal government’s health information technology website states (without reference) that “Broad use of health IT will: improve health care quality; prevent medical errors; reduce health care costs; increase administrative efficiencies; decrease paperwork; and expand access to affordable care.

St. Stephen’s Cathedral Panorama – Budapest

Wikipedia entry on St. Stephen’s, or Szent István Bazilika in Hungarian.

Our trip was made possible through the incredible generosity of my parents. We are truly blessed!

Dubai’s Debt Default

Asking to delay repayment on your debt – or defaulting, as the world’s press is carefully not calling it – has turned out not to be a good way for Dubai’s Sheikh Makhtoum to win friends and influence lenders to Nakheel, the property arm of the state-owned conglomerate Dubai World. Markets have tumbled worldwide; investors, reminded that governments can be subprime too, have dumped the debt of other dodgy-looking economies (including Greece); and in Dubai… everyone is on holiday.

What is surprising here is not that Dubai is on the verge of default. It is that anyone was willing to lend them ludicrous sums of money in the first place. Calculated Risk points out that Sir Win Bischoff, then at the (US) state-controlled Citi and now, appropriately enough, at the (British) state-controlled Lloyds Banking Group, was raving about raising $8bn of loans for Dubai last year and as recently as December chose to go public with a “positive outlook on Dubai”. Another non-surprise: state-controlled Royal Bank of Scotland was Dubai World’s biggest loan arranger. In the UK, Dubai World has been buying up a long list of property, according to Anita Likus at The Source; the assumption is it will shortly be selling.

More here.

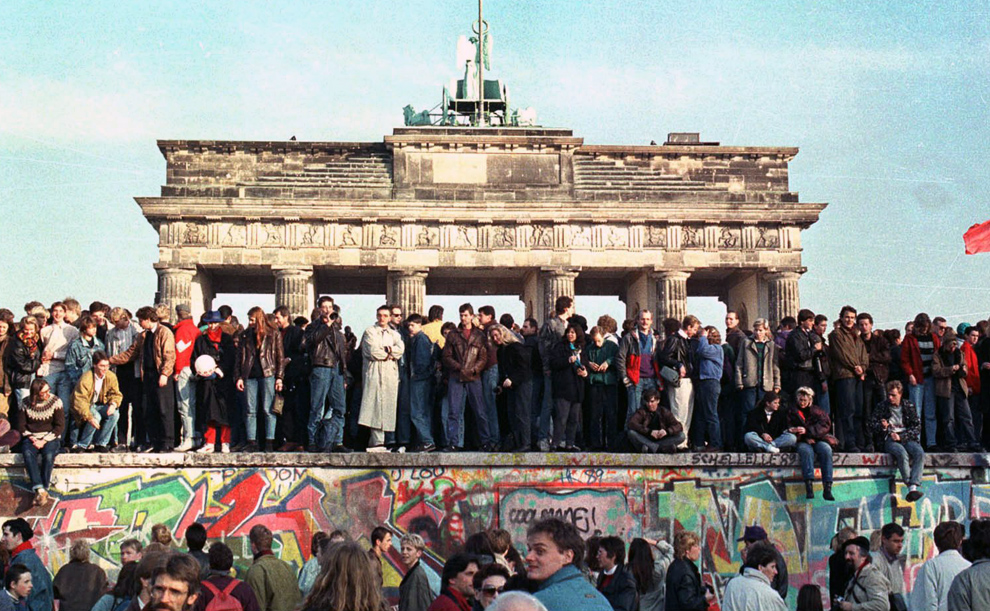

The Berlin Wall: 20 Years Gone

Twenty years ago, on the night of November 9, 1989, following weeks of pro-democracy protests, East German authorities suddenly opened their border to West Germany. After 28 years as prisoners of their own country, euphoric East Germans streamed to checkpoints and rushed past bewildered guards, many falling tearfully into the arms of West Germans welcoming them on the other side. Thousands of Germans and world leaders gathered in Berlin yesterday to celebrate the “Mauerfall” – the dismantling of the Berlin Wall and German reunification – and to remember the approximately 100-200 who died attempting to cross the border over the years. Collected here are photographs both historic and recent, from the fall of the Berlin Wall. Be sure to pause on photos 12 – 15, and click them to see a fade effect from before to after. (38 photos total)

Asia Trip Financial News

Now to the regional takeaway from our trip

We believe that few trust the United States. This is obvious in private conversation. And it is clear to all that confidence in the dollar is low. This is mostly mentioned only in private.

In public there is quiet response when the Treasury Secretary of the United States utters words about a strong dollar. Asians have heard that for years and with the many different accents of the various Treasury Secretaries. Geithner would serve the country better by ceasing to mouth the same words that his predecessor Snow and others used. He is not believed. Frankly, in some circles he is actually seen as an incompetent political hack. He is blamed by some for the insufficiency of the New York Fed under his presidency to supervise the primary dealers that failed – Countrywide, Bear Stearns, and Lehman. And the ethics issues surrounding the NY Fed under his tenure are viewed as appalling; this continues to surface in private conversations. Some folks are puzzled about why Obama maintains his support for Geithner. Some just attribute it to the President’s inexperience as a leader.

My takeaway is that our present Secretary of the Treasury is seriously and sustainably injuring the image of the United States. He has lost credibility. His actions are real and they impact markets. My conversations with those who are attempting to market GSE securities to Asians and getting rebuffed are validation enough for me on this point. When the Fed stops buying GSE mortgage backed securities, this reality will hit the markets in a re-pricing of that asset class. Spreads are going to widen.

The American federal budget deficits are worrisome everywhere. Policy promises from Washington to reduce them are greeted with great skepticism. Often they are privately described as American arrogance. Publicly, Asians are very polite and do not often subject their guests to embarrassing criticism. Privately they are quite candid. In my view they are correct: America is arrogant and seems to pretend that it is still the best and most trustworthy financial and capital market in the world. There is no basis for the US to have such a view of itself. We have squandered our reputational capital as a financial center leader.

Overture

Madison is truly blessed to have such a fine facility, courtesy of Jerry Frautschi’s landmark $200M+ gift. However and unfortunately, the financial spaghetti behind its birth is complicated and controversial, particularly at this moment when Overture’s parent lacks liquidity to fund the project’s remaining debt.

Yet, the facility is simply stunning. Have a look at these panoramic views.

Overture Hall Lobby:

MMOCA:

In an effort to preserve the pre-Overture scene, we shot panoramic images in 1999 and again, after construction in 2006.

I do have one financing suggestion. Give Goldman Sachs Lloyd Blankfein a call. After all, Goldman Sachs’ record bonuses are a direct result of massive taxpayer intervention to prop up certain banks and other “too big to fail” entities such as AIG. GS is well connected at the very top of our Government.

Presidential Cabinet Appointments: Private Sector Experience 1900-2009

A friend sends along the following chart. It examines the prior private sector experience of the cabinet officials since 1900 that one might expect a president to turn to in seeking advice about helping the economy. It includes Secretaries of State; Commerce; Treasury; Agriculture; Interior; Labor; Transportation; Energy; and Housing & Urban Development and excludes Postmaster General; Navy; War; Health, Education & Welfare; Veterans Affairs; and Homeland Security — 432 cabinet members in all.