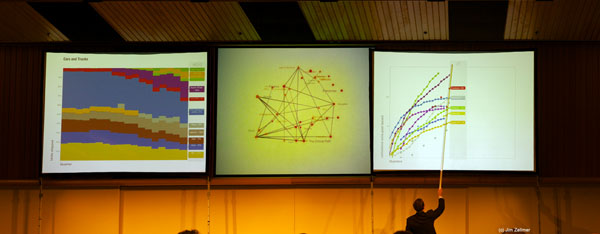

Horace Dediu (asymco.com, interview) reaches for a billion users at Asymconf Silicon Valley 2013.

Category: Current Events

Tales of the Unexpected

For almost a century, the world of economics and finance has been dominated by randomness. Much of modern economic theory describes behaviour by a random walk, whether financial behaviour such as asset prices (Cochrane (2001)) or economic behaviour such as consumption (Hall (1978)). Much of modern econometric theory is likewise underpinned by the assumption of randomness in variables and estimated error terms (Hayashi (2000)).

But as Nassim Taleb reminded us, it is possible to be Fooled by Randomness (Taleb (2001)). For Taleb, the origin of this mistake was the ubiquity in economics and finance of a particular way of describing the distribution of possible real world outcomes. For non-nerds, this distribution is often called the bell-curve. For nerds, it is the normal distribution. For nerds who like to show-off, the distribution is Gaussian.

The normal distribution provides a beguilingly simple description of the world. Outcomes lie symmetrically around the mean, with a probability that steadily decays. It is well-known that repeated games of chance deliver random outcomes in line with this distribution: tosses of a fair coin, sampling of coloured balls from a jam-jar, bets on a lottery number, games of paper/scissors/stone. Or have you been fooled by randomness?

In 2005, Takashi Hashiyama faced a dilemma. As CEO of Japanese electronics corporation

Maspro Denkoh, he was selling the company’s collection of Impressionist paintings, including pieces by Ce?zanne and van Gogh. But he was undecided between the two leading houses vying to host the auction, Christie’s and Sotheby’s. He left the decision to chance: the two houses would engage in a winner-takes-all game of paper/scissors/stone.

Recognising it as a game of chance, Sotheby’s randomly played “paper”. Christie’s took a different tack. They employed two strategic game-theorists – the 11-year old twin daughters of their international director Nicholas Maclean. The girls played “scissors”. This was no random choice. Knowing “stone” was the most obvious move, the girls expected their opponents to play “paper”. “Scissors” earned Christie’s millions of dollars in commission.

The Scene: Madison, Saturday, 9 June 2012

Black Swan? A Blackberry Store

I snapped this photo in Charlotte while quickly changing planes recently. Its presence caused me to do an about face as I had not previously seen a Blackberry branded retail store – nor did I ever expect to encounter such a place.

RIM was once a high flyer, but, via this informative Horace Dediu chart, has been unable to address the iPhone led smartphone disruption.

Black Swan Theory.

Brian S. Hall has been following the Smartphone wars for some time.

Which raises the question: Why are they here? If you’re here just to get reelected, you’re worthless to the country

Ezra Klein interviews Tom Coburn:

EK: It seems your view is that just as the market needs to have faith in your demographics and in the flexibility of your labor market and the competitiveness, it has to have faith in your political system’s capacity to deal with long and short-term threats. Do you see any reason for the market to have that faith right now?

TC: No. One of my biggest worries is what happens if Romney wins and Republicans control both chambers, do they have the courage to do what it takes to fix the country? It’s kind of their last chance. If they’re given the favor of control and they don’t act on it, why should you ever trust them again? You shouldn’t. It’ll be the death knell of the Republican Party. They controlled it all for four years under Bush and grew the government. They created a new entitlement with no revenue. Went against the very tenets of what they said they believe.

One of the reasons I wrote the book was to show a whole lot of people how many stupid things we do. I don’t really blame presidents too much. You gotta get appropriations. I say the problem is not that we don’t get along. We get along too well. Government is twice the size it was 10 years ago. The president can’t spend the money if we don’t appropriate it. So it’s not a president problem. It’s a congressional problem.

Paper Promises: Money, Debt and the new World Order

The world is drowning in debt. Greece is on the verge of default. In Britain, the coalition government is pushing through an austerity programme in the face of economic weakness. The US government almost shut down in August because of a dispute over the size of government debt.

Our latest crisis may seem to have started in 2007, with the collapse of the American housing market. But as Philip Coggan shows in this new book, Paper Promises: Money, Debt and the new World Order which he will talk about in this lecture, the crisis is part of an age-old battle between creditors and borrowers. And that battle has been fought over the nature of money. Creditors always want sound money to ensure that they are paid back in full; borrowers want easy money to reduce the burden of repaying their debts. Money was once linked to gold, a commodity in limited supply; now central banks can create it with the click of a computer mouse.

Time and again, this cycle has resulted in financial and economic crises. In the 1930s, countries abandoned the gold standard in the face of the Great Depression. In the 1970s, they abandoned the system of fixed exchange rates and ushered in a period of paper money. The results have been a long series of asset bubbles, from dotcom stocks to housing, and the elevation of the financial sector to economic dominance.

Kodak Files for Bankruptcy Protection

IT WAS the Apple of its era. Just like the late Steve Jobs with computers and music-players, George Eastman (pictured below behind the camera, with Thomas Edison) did not invent the camera and photographic development. But he simplified the technology. He outmaneuvered rivals. And he marketed his products in novel ways.

Yet the empire Eastman started to build at the end of the 19th century, and which dominated the 20th, did not last long into the 21st century. On January 18th Eastman Kodak filed for Chapter 11 bankruptcy protection in New York. The firm was laid low by the rapid shift to digital photography and away from film, where Kodak once earned 70% margins and enjoyed a 90% market share in America.

These handsome profits meant that the firm could invest huge sums in research and development. Yet ironically, extensive R&D contributed to Kodak’s undoing, since the firm ended up pioneering the very digital cameras that went on to kill its core business. The profits also allowed Kodak to be a generous and caring company for generations of employees in Rochester (New York), where it is based, and beyond. This, too, added to its troubles, since its pension obligations left it with less capital to diversify or invest in promising areas that might have saved it.

Apple and the American economy

THE macroeconomic discussions that Apple’s success prompts tend to be very curious things. Here we have a company that’s been phenomenally successful, making products people love and directly creating nearly 50,000 American jobs in doing so, criticised for not locating its manufacturing operations in America, even as Americans complain to Apple about the working conditions of those doing the manufacture abroad: life in dormitories, 12-hour shifts 6 days a week, and low pay. It isn’t enough for Apple to have changed the world with its innovative consumer electronics. It must also rebuild American manufacturing, and not just any manufacturing: the manufacturing of decades ago when reasonable hours and high wages were the norm.

The utility of Apple, however, is that it does provide a framework within which we can discuss the significant changes that have occurred across the global economy in recent decades. Contributing to that effort is a very nice and much talked about piece from the New York Times, which asks simply why it is that Apple’s manufacturing is located in Asia.

Dems’ SOPA support risky in 2012

The technology industry might be crucial for the economy of Wisconsin’s second-largest city, but our congressional delegation has been reluctant to heavily contribute to the debate about SOPA and PIPA. It took until Wednesday’s online “blackout,” in which The Badger Herald participated, for Madison’s own Democratic Rep. Tammy Baldwin to release a statement announcing she would not support the legislation.

Last Tuesday, Baldwin’s press representative said she had “some reservations” about the legislation. Baldwin still was staying unusually quiet about the issue.

Baldwin has rightfully earned her title as one of the most effective progressive voices in the House of Representatives. However, her reluctance to be one of the major progressive voices to come out early against SOPA and PIPA exposes several important aspects of her position in Congress, her campaign for Senate and the disappointing representation of Congress’ Democratic caucus.

Ever since her first Congressional victory in the 1990s, Baldwin has essentially been a shoo-in to win Wisconsin’s 2nd Congressional District. Still, she needs donations to keep her biannual campaigns afloat, and she predictably receives large donations from trade unions and equal rights advocacy groups.

A brief scan of the history of donations to Baldwin’s campaign committee might explain her reluctance to oppose SOPA immediately. In 2010, the National Cable and Telecommunications Association donated $10,000 to Baldwin’s campaign, tying it with three other unions as the top donor to the Baldwin campaign. Unsurprisingly, the NCTA is one of the many organizations affiliated with the entertainment industry that supports SOPA.

Peter Schneider Madison Talk

ACG 5 Peter Schneider – The American Council on Germany, Keynote Speaker, “Reinventing the Industrial Heartland” from Tracy Will on Vimeo.

I enjoyed Schneider’s October talk. Here’s his Wikipedia entry, and website.