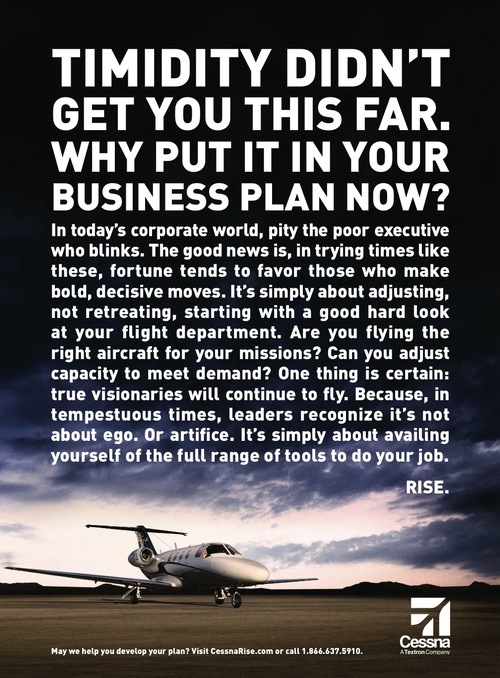

Our political class often avail themselves of private jets. There has been an effort to change the reimbursement requirements for Congressional use of private jets (pay the equivalent “First Class fare, rather than the full cost of the flight).

It is no secret that bailout transparency is a problem.

Now that taxpayers have become financiers, we have a right to know where the money is going. In search of organizations with the curiosity and resources to help figure that out, we trolled the Internet for good, easily available bailout information and came up with several sites worth looking at.

You can get charts describing the allocation of bailout money from a variety of sources. Some are easier to find than others, and we’ll leave it up to the reader to figure out what it means that the WSJ has a quick link for the Super Bowl but not the bailout.

But even after you find them, charts will only get you so far.

If you are looking to understand the big picture, you should go first to organizations that focus specifically on tracking the bailout. Not only do they piece together information from a variety of sources, saving you the trouble, but a few also do their own snooping around.

A good place to start is Open the Government, an organization devoted to greater government transparency in general, and with a specific page on the bailout. The page is a good launching pad because it compiles a lot of information—from government organizations, news outlets and watchdogs—as well as providing a calendar of relevant dates. In the spirit of common cause, Open the Government also links to other bailout watchdog groups.

A former chief executive officer of Goldman Sachs Group Inc. does not mingle with boat dealers; he mingles with investment bankers; and the first rule, before handing out taxpayer money, is to have mingled with the people you want to hand it to.(That way they know whom they owe). I admire your ability to recognize your “circle of competence” and live within it.

Still, I do feel that in me, and my little literary business, there is opportunity for you, and your $700 billion. Allow me to explain why.

Be Fair

1) By giving the money to me, instead of someone less deserving, you will make the world a fairer place.

As much as I admire all of your decisions I can’t help but notice that the main qualification of the bankers to whom you have been giving money, so that they might make smart loans, is that they have gone almost bankrupt by making stupid loans.

As your mind is subtle, I can only assume that you secretly believe that the American economy right now needs not smart loans, but more stupid ones — and thus that you have targeted the bankers who have proven they can make them.

I, unfortunately, have not flirted with bankruptcy, or made any stupid loans. But here’s my point: I haven’t been given the chance! Allow me to prove my financial ineptitude to you. I swear to you that when I return for my second round of assistance I will have proven myself fully qualified to receive it.

For writers who seek to influence public affairs, timing plays a paramount role. And few writers have had better timing than Adolf Augustus Berle.

In the summer of 1932, with America trapped in the greatest financial crisis in its history, Berle published “The Modern Corporation and Private Property,” a scholarly yet readable analysis of America’s largest companies and their managers. Berle is largely forgotten today, yet with that book he succeeded in persuading Americans to see their economic system in a new way — and helped set the stage for the most fundamental realignment of power since abolition.

The stock market had plunged vertiginously three years earlier, and by 1932 Americans were desperate to reverse the much wider collapse that had ensued — and to make sure it wouldn’t happen again. The New Republic was soon hailing “The Modern Corporation” as the book of the year, while The New York Herald Tribune pronounced it “the most important work bearing on American statecraft” since the Federalist Papers. Louis Brandeis would cite its arguments in a major Supreme Court ruling on corporate power. Running for president, Franklin Delano Roosevelt recruited Berle — a Republican Wall Street lawyer who had supported Hoover — to join his “brain trust,” and that fall entrusted him with drafting what became the most important speech of the campaign. After the election, Berle remained in New York, yet his connection to the president he audaciously addressed as “Dear Caesar” was such that Time would characterize “The Modern Corporation” as “the economic bible of the Roosevelt administration.”

Fascinating.

Listening to NPR this morning, I was somewhat amazed to hear this assertion during the top of the hour news: “stock futures opened lower today, not due to the election, but rather the weak economy“. How in the world do they have any idea? Personally, it must be the warmer than usual November Midwest weather 🙂

The market was up on election day.

Wisconsin polling locations can be found here.

A Madison street scene: “Obamanos 2008” in a classic Mercedes 280SE.

My email to Wisconsin Senators Russ Feingold and Herb Kohl. I also sent this to Congresswoman Tammy Baldwin:

Dear Senator Feingold:

I am writing to express my opposition to the proposed $700,000,000,000 toxic debt instrument bailout.

I believe it is wrong for us to continue the practice of spending beyond our means and simply passing more debt to our children and grandchildren. It is also wrong to stoke the fires of inflation.

If you believe these funds are necessary, then I suggest the following:

In other words, if necessary, support the initiative, but not on the backs of our children and grandchildren.

Best wishes,

Jim

Related:

A few years ago, I had an opportunity to hear “her deepness” Sylvia Earle speak. She included this short video in her presentation – “the Power of One“.

Earle emphasized the opportunities we all have to change the world. I recalled her talk while visiting with Hal Herron recently. Herron, of Riverton, Wyoming has been adding outdoor art to his home town in an interesting way.

Museums often create large banners to promote an exhibit. Herron sought out these banners after a showing is complete. He pays for shipping to Riverton and places them around the community for all to enjoy. Fascinating. He forwarded two photos, seen below:

Bill Perkin’s full page New York Times ad in today’s paper is another illustration of the “Power of One”.

Perkins approach requires a certain size checkbook, of course 🙂

All of which reminds me of the “two greatest commandments”.

TAMMY WYNEN stands near the back of a crowd outside a paper mill in Kimberly, Wisconsin. At a bank of microphones, speakers rail against Adam Smith; one, from the United Steel Workers, literally blames “The Wealth of Nations” for the mill’s impending closure. Many also hint that the soon-to-be unemployed mill workers should vote for Barack Obama in November.

But Mrs Wynen, a 27-year veteran of the paper mill, is not so sure. She cannot remember the last time she saw Mr Obama recite the pledge of allegiance. And her family loves Sarah Palin, John McCain’s new running-mate. Her children have lines from Mrs Palin’s convention speech off pat. Still, Mrs Wynen says she doesn’t know who she will vote for. The candidates look poised to spend a lot of time and money in Wisconsin wooing her.