Smiles could only be found on Penn State fans’ faces during Saturday evening’s 48-7 victory over Wisconsin at Camp Randall.

A fan was tasered nearby.

Smiles could only be found on Penn State fans’ faces during Saturday evening’s 48-7 victory over Wisconsin at Camp Randall.

A fan was tasered nearby.

When the 12,000 person city of Monticello, Minnesota voted overwhelmingly to put in a city-owned and -operated fiber-optic network that would link up all homes and business to a fast Internet pipe, the local telco sued to stop them. Wednesday, District Court Judge Jonathan Jasper dismissed the suit with prejudice after finding that the city was well within its rights to build the network by issuing municipal bonds. In this case, however, a total loss for the telco might actually turn out to be a perverse sort of victory.

The judge’s ruling, a copy of which was seen by Ars Technica, is noteworthy for two things: (1) the judge’s complete dismissal of Bridgewater Telephone Company’s complaint and (2) his obvious anger at the underfunding of Minnesota’s state courts. Indeed, the longest footnote in the opinion is an extended jeremiad about how much work judges are under and why it took so long to decide this case, even going so far as to cite approvingly a newspaper editorial backing more funds for the court.

Bridgewater’s basic complaint was that cities in Minnesota are not allowed to use bonds in order to offer data services to residents, because they lack the necessary authority. State statute says that such bonds may be issued for a host of projects (sewers, stadia, playgrounds, and “homes for aged,” among others), and they can more generally be used to fund “other public conveniences.” But is Internet access a “public convenience”?

More here.

Thank you for contacting me to share your thoughts on the administration’s proposal to purchase up to $700 billion of bad mortgage debt. I very much appreciated hearing from you.

I opposed the bailout plan passed by Congress, because though well intentioned, and certainly much improved over the administration’s original proposal, it remained deeply flawed. It failed to offset the cost of the plan, leaving taxpayers to bear the burden of serious lapses of judgment by private financial institutions, their regulators, and the enablers in Washington who paved the way for this catastrophe by removing the safeguards that had protected consumers and the economy since the great depression. Second, this bill did not include meaningful provisions to help families facing foreclosure. This is more than just a matter of fairness – the housing crisis is the root cause of the credit market collapse, and unless we address it, any rescue package is far less likely to work. Finally, the measure failed to address the deeply flawed regulatory structure that paved the way for this crisis. Taxpayers deserve a plan that puts their concerns ahead of those who got us into this mess.

Again, thank you for contacting me. Please feel free to do so again in the future.

Late afternoon light.

Late afternoon light.

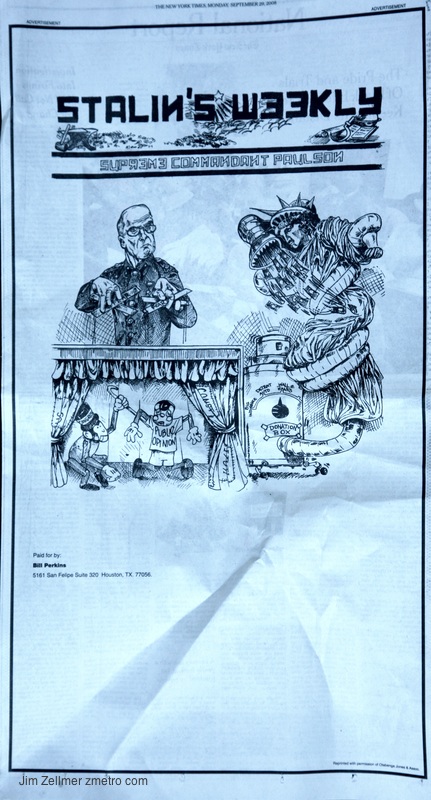

Appeared recently in the New York Times print edition. More here.

Declan McCullagh notes the large amount of pork in the bill that passed Friday.

These panoramas are the result of 8 days of “panographing” the city of Istanbul, as a guest of Atilla Aksoy from Works, the turkish advertising agency.

This material will be used to promote Istanbul as “European Capital of Culture in 2010”.

The proposed legislation would authorize Treasury Secretary Henry M. Paulson Jr. to initiate what is likely to become the biggest government bailout in U.S. history, allowing him to spend up to $700 billion to relieve faltering banks and other firms of bad assets backed by home mortgages, which are falling into foreclosure at record rates.

The plan would give Paulson broad latitude to purchase any assets from any firms at any price and to assemble a team of individuals and institutions to manage them. In wielding those powers, Paulson and others hope to contain a crisis that already has caused the failure or forced the rescue of a half-dozen major Wall Street firms and unnerved markets around the world.

Congressional negotiators have now completed action on a $700bn authorisation for the bail-out of the financial sector. This step was as necessary as the need for it was regrettable. There are hugely important tactical issues regarding the deployment of these funds that the authorities will need to consider in the weeks and months ahead if the chance of containing the damage is to be maximised. I expect to return to these issues once the legislation is passed.

In the meantime, it is necessary to consider the impact of the bail-out and the conditions necessitating it on federal budget policy. The idea seems to have taken hold in recent days that because of the unfortunate need to bail out the financial sector, the nation will have to scale back its aspirations in other areas such as healthcare, energy, education and tax relief. This is more wrong than right. We have here the unusual case where economic analysis actually suggests that dismal conclusions are unwarranted and the events of the last weeks suggest that for the near term, government should do more, not less.

My email to Wisconsin Senators Russ Feingold and Herb Kohl. I also sent this to Congresswoman Tammy Baldwin:

Dear Senator Feingold:

I am writing to express my opposition to the proposed $700,000,000,000 toxic debt instrument bailout.

I believe it is wrong for us to continue the practice of spending beyond our means and simply passing more debt to our children and grandchildren. It is also wrong to stoke the fires of inflation.

If you believe these funds are necessary, then I suggest the following:

In other words, if necessary, support the initiative, but not on the backs of our children and grandchildren.

Best wishes,

Jim

Related:

Some 258 parties, a number of them hosted by lobbyists for the finance, insurance, and real estate industries, have been thrown for members of the U.S. House Financial Services Committee this year, according to an investigation by the Sunlight Foundation’s Party Time project. Members of the House committee, along with the Senate Banking Committee, are considering the $700 billion bailout legislation for the financial sector proposed by the administration.

A sampling of parties include:

Apart from the fact that JetBlue Airways will offer passengers free Wi-Fi at its new Terminal 5 at New York JFK airport (as it does in Terminal 6), my favourite part of the new facility is…

The remote food ordering systems in the gate areas! Called re:vive, the touch-screen monitors let travellers order meals that are delivered directly to their gate-side tables.

Re:vive received a tremendous reception at Monday’s ribbon-cutting ceremony, with plenty of “oohs and aahs” from the crowd.