Sunrise, Labor Day 2008

Fitchburg, WI

Vintage, Classic Cadillac

1940’s?

1940’s?

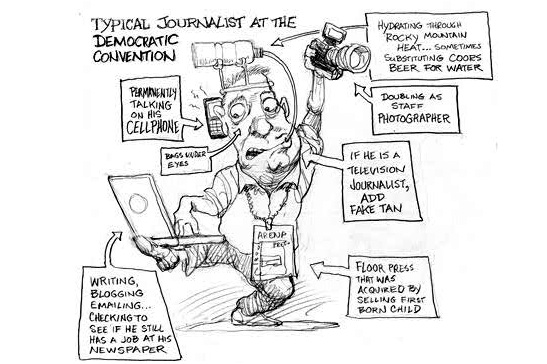

Political Cartoonist KAL at the Democratic Convention

Every day this week, our cartoonist is sending his sketches from the Democratic convention in Denver, Colorado. Sketches from previous days can be found here. You can find up-to-the-minute coverage on our American politics blog.

Beijing’s Ghost Town

About ten hours after the end of last night’s closing ceremony, I headed to the Olympic Green, completely unsure of what I’d find when I got there. I hadn’t heard much about when the Green will open to the ticketless public, or if it would stay open until the Paralympics — so I knew it would either be packed to the brim, or completely deserted. I arrived to find the latter.

When I approached the Olympic subway line, the streets packed with tourists and scalpers just yesterday were now empty, and only one of dozens of security checkpoints to access the subway was open — and there wasn’t even anyone in line. Unsure if my accreditation card would still be valid, I approached the checkpoint to find a guard waving me through. Two of the guards were even taking a nap — it was obvious that I was their first customer for quite some time.

A narrated slide show on the latest Texas Monthly Cover

Five Ways Newspapers Botched the Web

Here’s our theory: Daily deadlines did in the newspaper industry. The pressure of getting to press, the long-practiced art of doom-and-gloom headline writing, the flinchiness of easily spooked editors all made it impossible for ink-stained wretches to look farther into the future than the next edition. Speaking of doom and gloom: Online ad revenues at several major newspaper chains actually dropped last quarter. The surprise there is that they ever managed to rise. The newspaper industry has a devastating history of letting the future of media slip from its grasp. Where to start? Perhaps 1995, when several newspaper chains put $9 million into a consortium called New Century Network. “The granddaddy of _______,” as one suitably crotchety industry veteran tells us, folded in 1998. Or you can go further back, to ’80s adventures in videotext. But each tale ends the same way: A promising start, shuttered amid fear, uncertainty, and doubt.

Dangerously in Debt

Former U.S. Comptroller General David Walker speaks out on the perils of the rising federal deficit in the new film “I.O.U.S.A.

If “An Inconvenient Truth” sounded the alarm on global warming, “I.O.U.S.A.,” a new documentary opening in theaters Friday, hopes to do the same for the rising federal deficit.

Backed by Blackstone Group Chairman Peter Peterson, “I.O.U.S.A.” follows former U.S. Comptroller General David Walker and the Concord Coalition’s Robert Bixby on a “fiscal wake-up tour” across America. In the movie, which is co-written by “Empire of Debt” co-author Addison Wiggin and directed by “Wordplay” filmmaker Patrick Creadon, Messrs. Walker and Bixby argue that unless the government alters its policies and spending habits, the U.S. will be in for a serious financial meltdown.

The Diver’s View

A beautiful vr scene from the diving platform in Beijing, host of the 2008 Olympic Games.

Confessions of a Risk Manager

Why did banks become so overexposed in the run-up to the credit crunch? A risk manager at a large global bank–someone whose job it was to make sure that the firm did not take unnecessary risks — explains in his own words

IN JANUARY 2007 the world looked almost riskless. At the beginning of that year I gathered my team for an off-site meeting to identify our top five risks for the coming 12 months. We were paid to think about the downsides but it was hard to see where the problems would come from. Four years of falling credit spreads, low interest rates, virtually no defaults in our loan portfolio and historically low volatility levels: it was the most benign risk environment we had seen in 20 years.

As risk managers we were responsible for approving credit requests and transactions submitted to us by the bankers and traders in the front-line. We also monitored and reported the level of risk across the bank’s portfolio and set limits for overall credit and market-risk positions.