This is usually a slow time of the year for farm sales. It’s past prime planting season. Yet, Sam Kain, Des Moines area manager for land sales at Farmers National, is busy. He has 3 auctions this week. Most of the 30 or so bidders who show up will be farmers. But an increasing number of people buying land these days have no intention of planting seeds, at least not themselves. They are investors and a growing number of them are getting interested in farmland.

Just how hot is American farmland? By some accounts the value of farmland is up 20% this year alone. That’s better than stocks or gold. During the past two decades, owning farmland would have produced an annual return of nearly 11%, according to Hancock Agricultural Investment Group. And that covers a time period when tech stocks boomed and crashed, and housing boomed and crashed. So at a time when investors are still looking for safety, farmland is becoming the “it” investment.

Category: Real Estate

Madison’s Building “Boomlet”

Even as Madison, Wis., suffers arctic-like temperatures, there is a warm ray of hope for the commercial real-estate industry.

The city’s academic sector is seeing a building boomlet while developers in other parts of the country slam the brakes on new office buildings, stores and shopping centers.

A student-services hub at the University of Wisconsin-Madison is part of a larger mixed-use project called University Square.

About $600 million of new building projects are under construction on the University of Wisconsin-Madison campus and more than $450 million of additional projects are in the planning stage, said Alan Fish, associate vice chancellor of facilities planning and management at the university.A student-services center will officially open to students this week in a larger mixed-use development called University Square. The 1.1-million-square-foot project developed by Executive Management Inc., of Madison, also includes a rooftop garden, rental housing and about 125,000 square feet of retail space that is about 55% leased. The project, on the edge of the campus, is on land previously occupied by a one-story retail property, Mr. Fish said. Also under construction is the $150 million Wisconsin Institutes for Discovery, an interdisciplinary research complex scheduled to open in 2010.

The construction, part of a continuing effort to update the campus’s facilities since the 1990s, isn’t just changing the face of secluded ivory towers. “We’re smack dab in the middle of Madison,” Mr. Fish said. “Clearly the dynamism the campus has exhibited in the last five years has had a big ripple effect.”

Pleasant Rowland Lists Homes in Aurora, NY

Pleasant Rowland, the founder of doll company American Girl who spent six years and millions of dollars restoring much of Aurora, N.Y., has put both of her houses there on the market.

From 2001 to 2006, Ms. Rowland renovated town buildings owned by Wells College, her alma mater. Some townspeople criticized the renovations as too extensive. “I just simply saved a town that was crumbling,” Ms. Rowland says now. “My work there is completed.” She says the dispute isn’t her reason for leaving town.

One of the houses in Aurora, which is 46 miles southwest of Syracuse, is a 10,000-square-foot Queen Anne lakefront mansion built about 1902 with six bedrooms. It could use some interior renovation, Ms. Rowland says, and comes with 200 feet of frontage on Cayuga Lake, a dock and a boathouse. The two-acre property is listed for $2.2 million. The other house, an 1830 Federal-style home of 4,000 square feet with three bedrooms, is restored, Ms. Rowland says. The four-acre property is listed for $2 million.

In 1985, Ms. Rowland founded American Girl, which Mattel bought for $700 million in 1998. These homes represent the last of Ms. Rowland’s recent ties to Aurora. Last week, she sold Aurora-based MacKenzie-Childs, a decorative-tableware and home-furnishings company. She’s based in Madison, Wis. Paddington Zwigard of Brown Harris Stevens has both home listings.

It must be noted that former Mattel CEO Jill Barad signed the $700M check.

First Quarter 2008 Real Estate Market Source

In our last issue of the Real Estate Market Source, we predicted a slow ? rst quarter for residential closings, followed by an uptick in the second quarter (see www.starkhomes.com for back issues of the Real Estate Market Source). Well, we were certainly correct about the soft ? rst quarter. However, an increase in customer inquiry and showing activity after spring break gives us reason to hope that the second quarter might also meet our projections.

It appears closings will be off roughly 25% from the ?rst quarter of 2007 in the combined Dane, Sauk, and Columbia markets. We admit that this is an even bigger drop than we anticipated. However, we also didn’t anticipate a record snowfall year, when many weekends in January and February were virtually wiped out as far as showings go. The earliest possible Easter didn’t help either, as activity is always reduced in the weeks before and after the holiday for academic spring breaks. Excuses aside, this was a rough quarter.

On the brighter side, since late March, we’ve seen a noticeable increase in activity on our web site, in open houses, and in our showing volumes.

Showings on our listings were off 18% in January and February, but were even with last year in March, and are on pace to be over 20% ahead of last year in April. Offer activity is picking up as well. Pending sale data in the MLS is notoriously unreliable and always late in being reported, so we won’t really know until May or June if the market overall is taking a real turn. But the traf?c signals are certainly positive.

The US sub-prime crisis in graphics

BBC:

The US sub-prime mortgage crisis has lead to plunging property prices, a slowdown in the US economy, and billions in losses by banks. It stems from a fundamental change in the way mortgages are funded.

Traditionally, banks have financed their mortgage lending through the deposits they receive from their customers. This has limited the amount of mortgage lending they could do.

In recent years, banks have moved to a new model where they sell on the mortgages to the bond markets. This has made it much easier to fund additional borrowing,

But it has also led to abuses as banks no longer have the incentive to check carefully the mortgages they issue.

A Glimpse of Pottersville

THE 1946 MOVIE IT’S A WONDERFUL LIFE has become a holiday favorite for many Americans. The heart-rending story of George Bailey (played by Jimmy Stewart), who in his hour of despair is vouchsafed a glimpse of what the world would be like if he’d never been born, holds great meaning for many Americans. So does the drama played out between George and his father, Peter, and their professional nemesis, rich old banker Henry Potter (Lionel Barrymore), which provides a vivid look at the dramatic changes that had taken place in American finance in the years leading up to the time the movie was made.

The recent problems in the mortgage market bring the story and its characters to life once again. The Baileys and Old Man Potter disagreed about a number of things, but principally about the credit-worthiness of what Potter calls “the riff-raff,” the average citizens in their home town of Bedford Falls. The Baileys believe they are credit-worthy, and Potter generally does not.

Potter remembers the recent past, when lenders made the rules, insisting on repayment in gold coin or its equivalent, on big down payments and short terms. Most important for middle-class folks, Potter sees residential real estate as illiquid, mediocre collateral. George and Peter Bailey and their Building & Loan envision a future of suburban development, of small down payments and decades to pay. When George looks at the world had he never been born — and sees a vacant field instead of the Bailey Park housing development financed by the Bailey Building & Loan — he is looking at what would have been Pottersville.

Dave Stark’s 3rd Quarter Real Estate Market Newsletter

Dave Stark: [432K PDF]

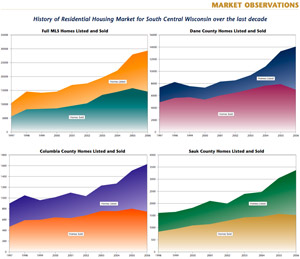

My, my, this was certainly an interesting quarter of activity in the South Central Wisconsin real estate market! For a while there, it was looking like we might start to see an uptick in activity compared with the 3rd quarter of 2006. In fact, note that single family home sales for the third quarter in the combined Dane, Sauk, and Columbia markets are off only 1% from the same quarter of 2006. For the year, they’re off only 3%. Condo sales are off a little more, falling 14% for the quarter and 11% for the year. As we said in our last edition, the market appeared to have settled into a groove, down roughly 10-12% from the unrealisticallyfrantic 2005 pace.

And then, in mid August, the Great Sub-Prime Fiasco hit the national media like a nuclear bomb, and things changed dramatically. Within the third quarter numbers, reported closings in September are off nearly 24% from last September (as of this writing*). That shows you just how drastically things changed in mid-stream. The sensational reports speculating that Countrywide might go bankrupt seemed to throw the market into a kind of paralysis, and buyers scuttled to the side lines again just when they seemed to be finding the courage to come back onto the field.

Unfortunately, as has been the case throughout this period, the perceptions the public is being left with range from overstated to just plain wrong. While the events of August were real, our experience is that most local home buyers and sellers don’t understand what it means for us. The media has done a very poor job of distinguishing between what’s going on nationally and what’s going on here locally. The impression many people have is that foreclosures are skyrocketing, foreclosed homes are flooding the market, driving up inventories, lenders are going out of business so that home loans are no longer available, interest rates on the few loans that are available are rising, and home prices are plummeting. None of these things are remotely true in our local market. But as the September closing numbers suggest, these perceptions do have an influence on people’s behavior in the short run. Yes, something is going on, but what is it, really?

Dave Stark is a longtime friend and client. www.starkhomes.com

Dave Stark’s Second Quarter (2007) Madison Area Real Estate Market Update

As we pass the half way point in 2007, the underlying forces that are driving the South Central Wisconsin real estate market are starting to define themselves, and as they do so, the future course of things is coming into

focus. After a year of confusing and often contradictory signals, the market seems to be settling into a somewhat predictable groove. The bad news, if you choose to view it that way, is that it’s looking more and more apparent that we won’t be returning any time soon to the go-go market of a couple years ago. On the other hand, demand is remaining relatively constant, and that should set the stage for a return to equilibrium.

In Dane County, single family sales were down 4% in the second quarter, and only 2% year to date, but they’re off 13% year to date from their 2005 high. Sauk and Columbia Counties are off slightly more on a percentage basis, but because they are smaller markets, they don’t change the overall percentages much. If we add in condos, sales for the first half of the year are down about 5.5% in this three county area compared to last year, and down about 11.6% from the 2005 record. So, as predicted, sales have stabilized in the first half of 2007, and we’re expecting the rest of the year to follow a normal seasonal pattern. Prices remain firm in all markets.

The second half of 2006 was much slower than the first, so it will be interesting to see how the second half of 2007 compares. Based on current offer activity, we’re backing off our earlier prediction that the second half of 2007 will be up 5 to 10 percent over 2006. But we don’t expect much falloff either. In other words, we seem to have found a new level of activity, about 10-12% below the record, and unsustainable, pace of a couple years ago.

Dave Stark’s First Quarter 2007 Real Estate Market Report

Dave Stark [480K PDF]:

So far, 2007 seems to be unfolding pretty much to form. In our last newsletter (4th Quarter 2006), we predicted that closings reported in the first quarter of 2007 would run slightly behind closings for the first quarter of 2006. As of mid April 2007, sales reported to the South Central Wisconsin MLS for the first quarter trail last year by 8%. This probably overstates the drop, since stragglers will continue to report closings for the next few months. It wouldn’t surprise us if another 100 or so sales will be on the books when we look back next year. Nonetheless, there are a number of very positive, and underreported, trends at work behind those numbers that bear analyzing.

Inventories: In the chart below, you see that inventories have risen slightly from the same period a year ago, although not nearly as much as they did the year before that. However, if you compare both inventories and the pace of sales to 3 months ago, you’ll see that the number of days of inventory on the market have actually fallen for both single family homes and condos (see chart, p.2). Condo inventory on the MLS hasn’t grown at all since the 4th quarter, although it remains stubbornly high. Building permits are down even further this year than they were last year, which will continue to hasten the fall in inventories.

New Construction vs. Resale Housing:For all of 2006, single family sales fell 7.8% for the entire South Central Wisconsin market, and 11.1% for Dane County. However, if you break those sales up into new and used, you see a different picture. Single family resales were down only 5.5% for the entire market, and 6.2% in Dane County. New construction, by contrast, was down 20.1% for the entire market, and 27.2% for Dane County. For the first quarter of 2007, resales are down only 1.4% for the entire market, and are actually up 1.5% in Dane County. New construction sales, however, were down 30% in Dane County for the first quarter of 2007 compared to a year ago.

There is always a 30 to 60 day lag between offers and closings, so the numbers you’re seeing for the first quarter reflect activity from the holidays and January/February, always the slowest time of the year for offers. So far, offers have tracked pretty closely with a year ago, which is good news, because the first half of last year wasn’t that bad. If we have a “normal” second half of 2007, we should have a much better year than last.

The report includes a useful look at Sub-Prime Lending. Dave Stark is a friend and long time customer.

2006 Local Real Estate Review

Dave Stark [450K PDF]:

Dave Stark [450K PDF]:

Regular readers of this newsletter will know that 2006 was, to put it mildly, a strange year in real estate. Despite continued record low interest rates and a relatively strong economic and employment picture, it’s well known that housing sales in South Central Wisconsin took a breather in the second half of the year.

What was particularly startling was how sudden and pronounced the change was from the first half of the year to the second. The good news is that, at least as of this writing, it appears that the recovery could be equally as sudden, and perhaps as dramatic.

For the year, sales of single family homes and condos were down roughly 8% in the area covered by the full South Central Multiple Listing Service. However, for the first 6 months of the year, sales were basically flat, down about 1%. For the second 6 months, sales were down 14.5%. In Dane County, the slowdown was even more dramatic; sales were down 4.7% in the first half of the year, but down 19.2% in the second half. For the year, Dane County was off roughly 12%. In Sauk and Columbia Counties, sales were actually up almost 4% in the first half of the year, but down almost 10% in the second half, and off about 3% for the year overall.

The question this all begs is: Why did this happen? And, perhaps more important: When will things turn back up?

Dave Stark is a friend and long time customer.