The NYT figured out that the way to fund journalism in 2026 is to make sure you can’t quit the crossword.

Consumer agents began to change how nearly all consumer transactions worked. Humans don’t really have the time to price-match across five competing platforms before buying a box of protein bars. Machines do.

WARN Firehose scrapes, normalizes, and unifies mass layoff notices from all 50 states into a single searchable database — updated daily. 109,000+ notices. 12.9M+ workers affected. Data going back to 1998. Available as interactive charts, bulk exports (CSV, JSON, Parquet), and a full REST API.

The Geometry of the Scoop; An overengineered interactive notebook exploring the differential geometry, materials science, fluid dynamics, and manufacturing topology of the Tostitos Scoops™ tortilla chip — arguably the most structurally sophisticated snack food ever mass-produced.

Within five years, Operation Breakthrough, the ambitious, but ultimately costly, delay-ridden and politically unpopular federal initiative that had propped up the Kalamazoo factory and eight others like it across the country, ran out of money. The dream of the factory-built house was dead — not for the first time, nor the last.

Over the past decade, I’ve worked to build the perfect family dashboard system for our home, called Timeframe. Combining calendar, weather, and smart home data, it’s become an important part of our daily lives.

The workflow I’m going to describe has one core principle: never let Claude write code until you’ve reviewed and approved a written plan. This separation of planning and execution is the single most important thing I do. It prevents wasted effort, keeps me in control of architecture decisions, and produces significantly better results with minimal token usage than jumping straight to code.

“The spending class IS the capital-owning class. The K-shaped recovery they fear actually stabilizes the demand base they say is collapsing. In the stable aggregate demand, the petit bourgeoisie finds ways to reinvent itself. I l ppl think the Citrini piece is excellent and worth reading. But history has repeatedly shown that periods of transformative productivity gains ultimately accrue to the consumer through lower prices, more leisure, and higher quality of life. Marx’s error wasn’t diagnosing the disruption, it was underestimating the system’s ability to adapt.”

The OpenClaw guy had five max subs and was losing 20k a month building and running his amazing project (because he was retired and had the money to set in fire) before AI labs banned this practice of having multiple subs. In case you just missed it: Because these agents are expensive as hell to run.

Keller and Abrams asked agents to eschew the doom and gloom of the current moment — home sales, they said, will likely be no better than 2025 — and think about the market in historical cycles, which show home values tend to trend up, building a solid source of wealth for homeowners. “Feelings — do not look at that,” Keller said. “Work with facts.”

Why should you care if you don’t own a tractor? Because when a combine goes down in the middle of harvest, it means fewer acres cut before the rain hits. It means grain that doesn’t get hauled on time. We like to imagine the food supply as a smooth conveyor belt. In reality it’s tight timing, thin margins, and a lot of heavy machinery that increasingly runs on proprietary software.

Understanding why businesses actually fail matters regardless of where you sit politically, because it is a matter of short- and long-term governance. When a retailer fails, state and local governments pick up the tab: lost sales tax revenue;, unemployment insurance claims, economic development incentives to attract replacement employers. If those failures are driven by demand shifts, that spending is a reasonable cost of economic transition. If they’re driven by capital structure decisions made at acquisition, taxpayers are subsidizing the back end of a private transaction they had no part in. If we misdiagnose Joann as a story about consumer preferences or e-commerce disruption, every downstream decision, from unemployment policy to pension allocation, starts from the wrong premise.

The initial architecture focused on brutal simplicity. I persisted a flat list of components that I would manually place by first sketching it out in Photoshop, and every frame the engine ran a minimal loop:

From a strategic standpoint, the US is not just an additional destination but a high-value test case for India’s transformation from a regional production base into a platform for global market access.

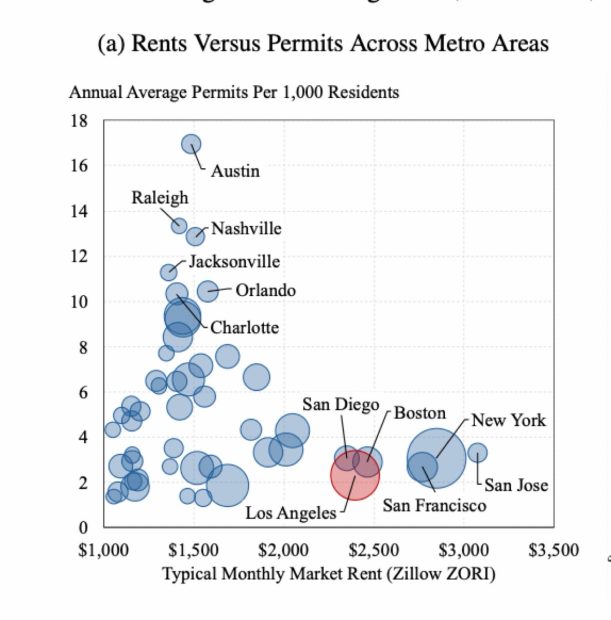

Permitting costs are widely cited, but little analyzed, as a key burden on housing development in leading U.S. cities. We measure them using an implicit market for “ready-to-issue” permits in Los Angeles, where landowners can prepay permitting costs and sell preapproved land to developers at a premium. Using a repeat-listing difference-in-differences estimator, we find developers pay 50 percent more ($48 per square foot) for preapproved land. Comparing similar proposed developments, preapproval raises the probability of completing construction within four years of site acquisition by 10 percentage points (30 percent). Permitting can explain one third of the gap in Los Angeles between home prices and construction costs. Keywords: building permit, land-use regulation, hedonic, zoning, capitalization. more.

We’re slowly losing one of the things that makes tennis genuinely great, surface diversity. This doesn’t show up in most audience analysis. In part because the creep of hard courts has been gradual, but also because it’s impossible to miss what you haven’t experienced. But there is an opportunity cost to having great players mostly ply their trade on one rather than three more evenly split surfaces, and an even greater cost to junior players optimising mostly for a hard court tour rather than a grass, clay, and hard court environment.

…The future of Substack is going to tilt toward writers with large audiences running completely unregulated pump-and-dump schemes through prediction markets. Buy low, tell your readers why X outcome is undervalued, sell high, pocket the difference. Not all Substack writers will make use of the Polymarket widget. But if you want the company to algorithmically promote your content, maybe you should try out this hot new gambling trend.

The cyberattack on Change Healthcare, first detected in February 2024, has grown into what appears to be the single largest exposure of personal health data in American history. UnitedHealth Group, the parent company of Change Healthcare, has estimated that approximately 190 million people were affected by the breach, a figure that dwarfs every prior federal data incident on record. The scale of the compromise, the simplicity of the initial intrusion, and the cascading disruption to medical billing and pharmacy systems across the country have forced a reckoning over how the nation’s largest health conglomerate secures the data of more than half the U.S. population.

The first is Audio Transcription in Notes. It records audio, transcribes it in real time, and summarizes the whole thing into key points. It’s built for meetings, lectures, interviews, and anything you want to capture and keep. The second is Live Captions. It transcribes any audio playing on your phone, or any sound happening around you, in real time. FaceTime calls, YouTube videos, podcasts, someone talking to you across a table. It works across every app on your phone and it doesn’t record anything. It just puts live subtitles on your screen.

LASIK eye surgery cost $2,200 per eye in 2000. Today it’s around $1,000 per eye despite 24 years of inflation. Meanwhile, an MRI that cost $1,200 in 2000 now costs $3,000+. The difference? LASIK operates in a free market with no insurance interference and minimal regulation.

Ever wondered how TSA was allowing illegal aliens to board commercial flights without IDs under the Biden regime? Well I sued TSA to find out and learned that Biden’s DHS allowed CONVICTED sex offenders on to flights by showing their sex offender paperwork.

New research shows that seasoned birders — including older adults — had denser tissue in parts of the brain tied to attention and perception.

But when his homegrown remote control app started talking to DJI’s servers, it wasn’t just one vacuum cleaner that replied. Roughly 7,000 of them, all around the world, began treating Azdoufal like their boss.

This article contends that the PE investment model imposes social costs in many portfolio companies through over-leverage, value extraction and short-term incentives. Part I shows how debt-driven acquisitions increase the probability of restructurings and job losses. Part II analyzes how profit pressure in PE portfolio companies can harm third parties including workers, healthcare patients, consumers, unsecured creditors, communities and the environment. Part III proposes limited, specific reforms—insurance and bonding requirements, minimum staffing and quality regulations, and increased disclosure requirements focused on sensitive industries and service sectors—that would require PE funds to internalize these foreseeable harms and provide federal and state regulators with the tools to identify and minimize related risks. This article concludes that these modest but targeted changes can preserve the benefits of the PE investment model while materially reducing externalized costs.

The Trump administration received at least 21 ideas to revitalize @Dulles_Airport. All would keep Saarinen’s iconic terminal but most would turn it into a ceremonial space with a new departures terminal elsewhere on airport grounds.

“South America has never offered me a deal good enough to seriously consider it. The Middle East has always been much better in terms of appearance fees. The European swing has also provided strong financial incentives. That makes a difference,” Tsitsipas, the former world No. 3, told CLAY.

A visual guide to the industrial processes you can no longer permit in the state of California — and the grandfathered facilities that still can.

In early December, Oren Hadar at The Future Is L.A. broke the news that the city of Los Angeles has quietly stopped resurfacing streets.

Jane Street is also where SBF learned to trade before founding FTX and Alameda Research, and many of his future colleagues came from the firm or intersected with its networks. According to the lawsuit filed by Terraform’s bankruptcy administrator Todd Snyder, Pratt became the bridge between his former employer and his new one through a chat group that court filings describe as “Bryce’s Secret.”

“The number of news stories published by the Post has fallen by 42% since 2020, while newsroom costs were 16% higher in 2025 compared with 2020, D’Onofrio said.”

The Gigacasting race isn’t just about tonnage. It’s about achieving the highest part reduction with the largest casting manufactured with the leanest process.

Bohemian Grove — Member Research: Data compiled from public sources: SEC EDGAR, OpenSecrets, LinkedIn, web biographies

Pre-pandemic: ?,??? ????????? ??? ??? ??????? ??????. FY2025: ?,??? ????????? ??? ?? ??????? ??????. That’s 15% more staff serving half the customers. Per-employee comp is up 32%, from $140K to $171K. Any private company that lost half its customers and then grew headcount would be bankrupt. BART just asks for a tax increase.

Howard Marks latest on “ai”.

Legacy platforms look very different. A typical mid-to-high-end vehicle still carries 70–120+ ECUs. The intelligent functions are spread across many specialized modules from multiple Tier-1 suppliers. Here is what changes when you drop in the Tesla box: Net effect: One Tesla box replaces the functional equivalent of 8–15 major ECUs or Tier-1 subsystems.

For the second year in a row, Trader Joe’s was the cheapest place to shop for groceries — this time by an even more significant margin. The same bag of items cost less than half as much as at Bi-Rite, this year’s priciest store. Independent grocers such as Mollie Stone’s, Luke’s Local and Gus’s Community Market all saw increases, though to varying degrees. We found nearly the exact same prices for most items at Safeway and Trader Joe’s as last year. Lucky was the only supermarket that saw decreases, though they were slight. (The Chronicle didn’t visit value-driven stores Grocery Outlet and Costco because of their inconsistent offerings, and omitted international grocery stores for the sake of direct comparison.)

The relevant bottleneck for humanoids is not “rare earths” in general, but the NdPr-to-magnet supply chain. China’s dominance in midstream processing and magnet manufacturing gives it leverage over the pace, cost curve, and industrial geography of embodied AI.

Massachusetts, long a bastion of progressive politics and high taxes, has quietly watched the equivalent of one-and-a-half Cambridges pack up and leave. A new analysis from the Pioneer Institute finds that more than 182,000 net domestic residents exited the commonwealth between April 2020 and July 2025, a sustained outflow that researchers describe as a lasting structural shift rather than a brief pandemic aftershock.

“If I recall, the timing between Apollo 7 and 8 was nine weeks,” the official said. “Launching SLS every three and a half years or so is not a recipe for success. Certainly, making each one of them a work of art with some major configuration change is also not helpful in the process, and we’re clearly seeing the results of it, right?”

The (Searchable) Whole Earth.

If Big Tech organized as a class, they could do it effortlessly, at personal costs they would hardly notice — but it’s obvious to anyone with even passing familiarity with these people that they will never do anything like this. Elon Musk is by far the most radical and iconoclastic of the Silicon Valley billionaires, and he’s nowhere near this — which would, itself, be an embarrassingly petty exercise of political power by the standards of the wealthiest men in history. (Or even in comparison with the industrialists of the turn of the 20th century.)

Covey died in a cycling accident in 2013, at fifty. When Bezos wrote about her afterward, the word he chose was not talented or dedicated. He said she had “a deep keel.”

so when Merz comes back and says we need to work a bit more I think he saw the problem but COMPLETELY misdiagnosed the solution, telling Germans to work harder is like telling a horse to gallop faster when the other side built a combustion engine.

The @SFBART board should be held responsible for their unconscionable mismanagement of the transit system, spending like drunken sailors as ridership plummeted by half, adding $100 million in new staff alone for an emptying system. Now they’re playing the nihilism doomsday card.

Microsoft puts final 5 buildings of $5B Redmond expansion on hold.

A Bitcoin baron wants to build a libertarian paradise on the island of Nevis. Democracy is getting in the way.