When the CIA director cannot hide his activities online, what hope is there for the rest of us? In the unfolding sex scandal that has led to the resignation of David Petraeus, the FBI’s electronic surveillance and tracking of Petraeus and his mistress Paula Broadwell is more than a side show—it a key component of the story. More importantly, there are enough interesting tidbits (some of which change by the hour, as new details are leaked), to make this story an excellent lesson on the government’s surveillance powers—as well as a reminder of the need to reform those powers.

Google ad revenue surpasses all of print media

Three weeks ago, we reported on the rise of online advertising. Over the past few years, online ads have quickly grown past newspaper and magazine advertising to become the second largest ad medium behind television.

We played with the numbers a little bit and found an interesting piece of information that nicely illustrates how ad markets have changed in the past decade: in the first six months of 2012, Google raked in $20.8 billion in ad revenue, while the whole of U.S. print media (newspapers and magazines) generated just $19.2 billion from print advertising. That is, Google, a company founded just 14 years ago, attracts more advertising money than an industry that has been around for more than a hundred years. Given the fact that Google operates globally, the comparison is obviously unfair and shouldn’t be judged scientifically, but nonetheless it shows how big Google’s ad business really is and how small print advertising has become.

2012 Wisconsin Original Cheese Festival Photos

Tap or click on the image to view a slideshow, here.

Linda Falkenstein:

Pairings, as I overheard at the fourth annual Wisconsin Original Cheese Festival, at Monona Terrace on Saturday, are hot. Certainly the concept is everywhere — and it seems the more unexpected the pairings, the better.

Pairings are about more than this wine goes well with this dish. Pairing events are more focused on slowing down the tasting experience. It’s not about eating per se. It’s about using the paired food and drink to bring out the subtle flavors within each.

I was impressed with a cheese and sake pairing session at 2010’s Wisconsin Original fest that revamped my impression of sake — high-end, artisanal sakes taste more like wine than mass-market sakes — and those featured at the tasting went well with the chosen cheeses. On the other hand, I have not had a sip of sake since that session two years ago. Old habits die hard.

At this year’s fest, Barrie Lynn, “the cheese impresario,” presented pairings of Wisconsin cheeses with Tennessee whiskeys.

Pairings, Lynn confirms, are “a Slow Food strategy.” And although when she leads a pairing session she’ll give plenty of hints for bringing out the flavors, her bottom line is to “rock out and have fun.”

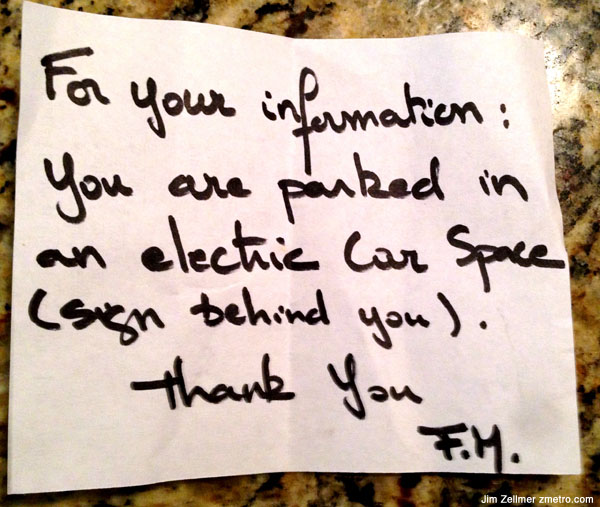

Sign of the Times: “For Your Information You Are Parked in an Electric Car Space”

Found on my windshield on a recent dark morning.

Up in the Air (10 Photos)

George Steinmetz‘s new exhibition and book, Desert Air, is the first comprehensive photographic collection of the world’s “extreme deserts”, which receive less than four inches of precipitation a year. This body of work, culled from 15 years of shooting, takes the viewer from China’s Gobi Desert to the Sahara in northern Africa to Death Valley in California.

Steinmetz photographs from a motorized paraglider which he describes as a “flying lawn chair”. Using the slowest and quietest powered aircraft in the world, he is not only able to take off and land without an airfield or government permission but is also likely to land in someone’s yard and be invited in for tea, becoming the talk of the town.

In his thirty year career, Steinmetz has been a regular contributor to National Geographic and GEO magazines and has won numerous awards including two first prizes in science and technology from World Press Photo. Desert Air will be on view through March 3, 2013 at Anastasia Photo.

Sandy inspires first Doctors Without Borders U.S. relief effort

NEW YORK, Nov 8 (Reuters) – Manhattan doctor Lucy Doyle has done stints with the global medical relief organization Doctors Without Borders in the Democratic Republic of Congo and Kenya. But her latest assignment is a real eye-opener: New York City.

In the wake of Superstorm Sandy, Doctors Without Borders has set up its first-ever medical clinic in the United States, and Doyle finds herself on the front line of disaster just miles from her day job.

“A lot of us have said it feels a lot like being in the field in a foreign country,” said Doyle, who specializes in internal medicine at New York’s Bellevue Hospital, now closed by Sandy’s damage.

Is apathy the new black death?

I live in Spain and seriously, nearly all if not all the people I meet lack enthusiasm, are generally lethargic and display signs of an acute aversion towards work and effort in general, not to speak of suffering. On the other hand, everybody’s going to demonstrations and protesting and complaining about everything, but generally doing nothing in the long term because that means hard work. This is seriously wearing me down. I’ve met along the years amazingly talented people that just want to do nothing, and I wonder if it is possible at all for me to do everything always alone while drowning in this apathetic pool of mud.

Magic’s about understanding—and then manipulating—how viewers digest sensory information

In the last half decade, magic—normally deemed entertainment fit only for children and tourists in Las Vegas—has become shockingly respectable in the scientific world. Even I—not exactly renowned as a public speaker—have been invited to address conferences on neuroscience and perception. I asked a scientist friend (whose identity I must protect) why the sudden interest. He replied that those who fund science research find magicians “sexier than lab rats.”

I’m all for helping science. But after I share what I know, my neuroscientist friends thank me by showing me eye-tracking and MRI equipment, and promising that someday such machinery will help make me a better magician.

I have my doubts. Neuroscientists are novices at deception. Magicians have done controlled testing in human perception for thousands of years.

How Zara Grew Into the World’s Largest Fashion Retailer

Galicia, on the Atlantic coast of northern Spain, is the homeland of Generalissimo Francisco Franco, but is otherwise famous for being a place people try to leave. For much of the 20th century, hundreds of thousands of gallegos, as they are called, emigrated to countries as far away as Argentina to escape Galicia’s rural poverty. Today, however, even as Spain teeters on the edge of economic catastrophe, the Galician city La Coruña has attracted notice as the hometown of Amancio Ortega Gaona, the world’s third-richest man — he displaced Warren Buffett this year on the Bloomberg billionaire index — and the founder of a wildly successful fashion company, Inditex, more commonly known by its oldest and biggest brand, Zara.

William Black on Geithner & Obama

I wish people would stop asking me for insight into what Tim Geithner has been thinking since June 2009. I think I understand the President–you work 90 hours a week, 30 of which are ceremonial, 30 of which are coalition maintenance, and 30 of which are policy, of which macroeconomic and financial policy are only one of ten important issue areas. Thus if you are a president you spend three hours a week on macroeconomic and financial policy–about 30% of what we expect freshman taking “Principles of Economics” to spend. You can’t master any of the technical issues. You have to trust advisors.

But Geithner? The current theory is that he really did not understand and did not want to understand the difference between 1993 and 2009–that there is a big difference between a situation in which there is a threatened run from and one in which there is an active run to Treasuries, and a situation in which the clean-up of the financial mess is already well in hand and one in which it needs to be undertaken.