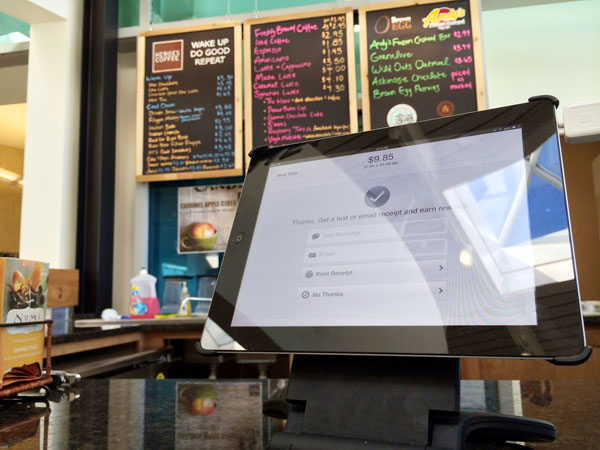

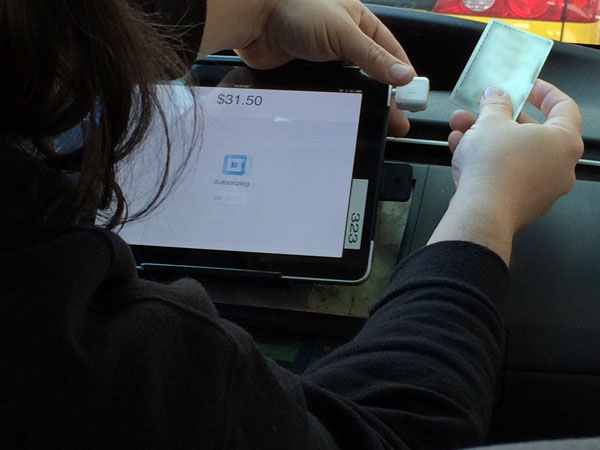

Green Tea. Salad. Oatmeal. Soup. Fruit. Yogurt. Bacon Cheddar Muffin (caught my eye at a sprout style coffee shop, but not for me). These are just a few of the items I’ve purchased when on travel using increasingly popular iPad “cash registers”. Interacting with them more frequently, I’ve begun to catalog installations and reflect on their use.

The term “cash register” [wikipedia] understates much of what the iPad and the supporting cloud software is actually doing. I often ask the attendant or proprietor how they like the iPad + software combination. The most popular response – admittedly, unscientific – is the ease with which they can manage their products and prices. One manager mentioned how difficult it was to reconfigure pricing and products on their previous Windows based “cash register”.

Apps + Cloud

The examples I’ve witnessed use a “cloud” based service: NCR “Silver”, Square and ShopKeep to name a few. The proprietor configures and manages the POS (“Point of Sale”) iPad system from a browser or a management app. Changes are often available immediately. The iPad provides a fast, touch interface to cloud-based data processing. In some ways, this phenomena is a return to the client/server era of the 1990’s.

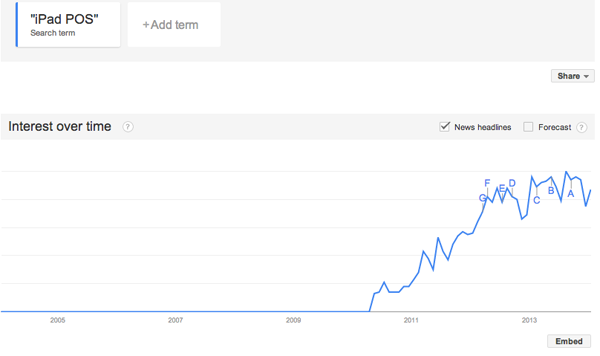

Google Trends “iPad POS”

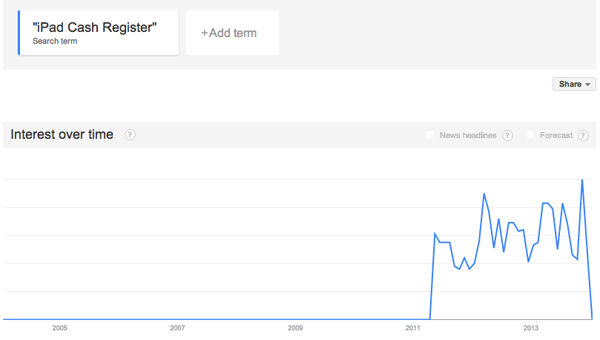

Google Trends “iPad Cash Register”

Productivity

I observed a number of clients selecting their contact record to tag a purchase for the store’s affinity program.

This points out another benefit of iPad Point of Sale Apps: clients can often enter or update their own information, saving staff time. The iPad stands quickly rotate so that the customer can complete their information and request a receipt – via email.

I observed one cafe with “black box” 7″ tablets tied to a POS system. Presumably we will see more payment service bundling, particularly from Google, Amazon and others.

But…..

“The cloud is not perfect, it’s not for everyone” – so said the owner of a multi-generation successful restaurant – still using traditional cash registers. I asked this fellow if he considered an iPad cash register app/service?

“You know, the cloud has flaws from privacy to business risk. I’ve looked and looked (and looked) for an iPad POS app that keeps my data local and have yet to find one. I want to control my data.”

Opportunities:

Software

One can imagine many interesting business and service combinations from banking, crm, delivery and ibeacons. New user experiences will emerge, perhaps including “frictionless” purchases via emerging credential services ala Touch ID.

iPad POS system growth is yet another indicator of the iOS eco-system’s strong developer appeal.

Hardware

The next logical step is to eliminate – or make irrelevant – the physical “cash register”, moving the order and payment process to the client’s device such as a smartphone and/or iPad. Perhaps the POS vendors, or one of the eco-system platforms will create and grow a pervasive location aware payment service that interacts with iBeacon-style devices.

Cloud Financial Data

I concur with the proprietor concerned about cloud financial data.

On a related personal data matter, I recently contacted Automatic to see if I might use their auto data tracking device and app without moving all of my information to their services (and “business partners”). I received this response:

This is technically possible, but not as easily done. As long as you have a data plan on your phone, it will upload data to our servers for processing. The only way to prevent it entirely is to not be connected to the internet at all. You’ll still need to connect initially to create an account for the setup process though.

Without an internet connection, trip recording may not work flawlessly all the time as some of it is dependent on our servers for processing. You won’t be able to install any firmware updates for the Link and other features of Automatic won’t work without a connection. Check out this topic in our Community for more information. http://community.automatic.com/automatic/topics/requiring_mobile_data_gps

-Ani

Customer Success

An optimist, I am hopeful that we will see more user controlled data options, soon.

Destiny

I suspect within 5 years (3?) the iPad cash register app model will be old news, largely replaced by location aware client devices.

Notes: The photos above were taken with my iPhone 5s, with the exception of the first, which was taken with my Sigma DP2m. The wood iPad POS stand was my favorite. It was found in a rather high-rent tea cafe.